Recently, an Administrative Law Judge ruled against the Department of Labor (DOL) in a very interesting case allowing the employer to recoup fees from an employee for the H-1B visa process. Before going into the specifics of the case, it is important to understand what the DOL regulations are in this area.

Recently, an Administrative Law Judge ruled against the Department of Labor (DOL) in a very interesting case allowing the employer to recoup fees from an employee for the H-1B visa process. Before going into the specifics of the case, it is important to understand what the DOL regulations are in this area.

The DOL, in its regulations governing both the PERM and H-1B process, has stated that the employer must pay the employee the higher of the actual wage for the position at the employer OR the prevailing wage. The DOL has gone further stating that certain deductions from an employee’s paycheck, while allowable under the law, are not permissible under the prevailing wage laws. Therefore, if those deductions bring the employee’s salary below the higher of the actual wage or the prevailing wage, then the employer is violating the regulations. These impermissible deductions include the filing fees and attorney fees (in fact all fees) for the H-1B and PERM processes, as the DOL sees all those fees as the employer’s responsibility.

One other issue in this area is what exactly is the “actual wage”. It would seem to make sense that it is the wage that the employer is actually paying the employee. However, the Department of Labor has not interpreted it this way. Instead, the Department of Labor makes the employer average the wages of all employees in the same OR substantially similar positions (positions that require the same education and skills). The Department of Labor reasoning is that they do not want the employer to impose a lower wage on a foreigner that a US worker, even if that lower wage is higher than the Prevailing Wage. This is the formula the DOL mandates for determining what the minimum wage that can be paid to an employee would be.

Now we can discuss the actual case. The case was Administrator v. Woodmen of the World Insurance Society (10/26/2016). In the case, the Woodmen of the World Insurance Society (employer) hired an H-1B non-immigrant had them sign a repayment agreement for the attorney and other fees. This particular employee was let go prior to the end of the H-1B, and the employer deducted the fees from the employee’s final paycheck, which included unused vacation time. It is important to note that the unused vacation time more than covered the H-1B fees that the employer recouped. The DOL audited the case (it is unclear if the employee complained (most probable) or it was a random audit) and determined that the money that the employer deducted was an impermissible deduction from the employee’s paycheck.

The DOL made two important findings. First, the DOL stated that, despite the fact that the employee was paid higher than the prevailing wage and the actual wage (as determined using the formula above), the employer was still liable. The DOL stated that in such cases the actual wage is actually just the wage paid to the employee. Therefore ANY impermissible deduction would bring the wage below the actual wage. The DOL further stated that the payments made to the employee for his unused vacation time in his last paycheck also could not be used to make payments as doing so would put the employee in a worse position than similarly situated US Citizen employees who do have these fees deducted from their paycheck. However, it is important to note that the DOL said that the fees for premium processing where NOT an impermissible deduction and therefore the employer could deduct those.

The Administrative Law Judge looking at this case only looked at the second argument relating to the vacation time and did NOT rule on what the actual wage was as it was not necessary for the case. In his ruling, the Judge stated that it IS permissible to make such deductions from unused vacation time as long as the employer makes similar deductions from US Citizen paychecks. For example, the Judge stated that the employer in the case at bar also deducted tuition that the employer had paid for an employee from such paychecks if the employee did not meet the terms of the repayment plan agreement. Therefore, according to the Administrative Law Judge, such deduction do NOT affect wages and, since US Citizens are treated similarly, does not put non-immigrants in a worse position than US Citizens. Once again, it is important to note that the unused vacation time payment more than covered the fees in question (the employee was due about $9000 in unused vacation and the attorney and filing fees were only about $4000).

This is the first time I am aware of, that an employer has been allowed to recoup such costs from an employee and sets out clear parameters for employers who would like to have such repayment agreements to follow.

Please remember, as always, this blog does not offer legal advice. If you need legal advice, consult with a lawyer instead of a blog. Thank you.

Recently, an Administrative Law Judge ruled against the Department of Labor (DOL) in a very interesting case allowing the employer to recoup fees from an employee for the H-1B visa process. Before going into the specifics of the case, it is important to understand what the DOL regulations are in this area.

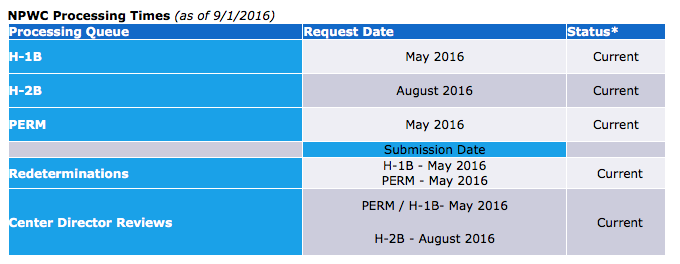

Recently, an Administrative Law Judge ruled against the Department of Labor (DOL) in a very interesting case allowing the employer to recoup fees from an employee for the H-1B visa process. Before going into the specifics of the case, it is important to understand what the DOL regulations are in this area. The DOL recently reported that Prevailing Wage requests for both H-1B and PERM cases are taking about 5 months to process. For those planning to file an employer sponsored PERM case, this means really advance planning is needed. Prior to advertising it is important to have the prevailing wage determination, otherwise you may have to re-do the advertising if the determination comes back higher than anticipated. For this reason we almost always advise our clients to wait for the prevailing wage determination before advertising.

The DOL recently reported that Prevailing Wage requests for both H-1B and PERM cases are taking about 5 months to process. For those planning to file an employer sponsored PERM case, this means really advance planning is needed. Prior to advertising it is important to have the prevailing wage determination, otherwise you may have to re-do the advertising if the determination comes back higher than anticipated. For this reason we almost always advise our clients to wait for the prevailing wage determination before advertising.